Posts

Concurrently, you obtained’t have the option doing your entire banking during the Barclays, since there are no checking profile provided. Without fee every month, minimal put needs or nonsufficient fund payment, you could start saving which have any harmony without having to worry from the fees offsetting the interest you have made. Desire substances everyday as there are no limitation to your count out of distributions otherwise transfers you may make. The brand new Barclays On the web Bank account fees few, if any, charges and will be offering an increased give no minimum deposit demands. When you’re the produce is competitive, it’s not the greatest on the market. Furthermore, Marcus doesn’t provide a checking account, very full-service financial isn’t a choice, and you can’t access your money via an automatic teller machine, putting some membership shorter much easier.

Cigarette and you will Vaping Tool Taxation

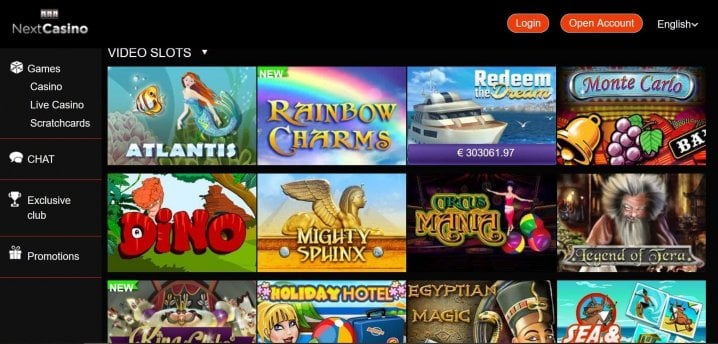

Would like to know and that day’s the newest month you’ll receive their consider? This is the Social Security and you will SSDI payment plan to have July. Keep reading to ascertain just how your commission time is decided, when to found their consider, as well as the helpful hints complete percentage schedule to your month from July. For lots more, don’t skip as to the reasons report Personal Security checks will minimize being sent aside in the near future. There are ranging from six and 11 on the web games to experience, based on should your matter private game or game versions. Make finest totally free spins incentives from 2024 from the the better expected gambling enterprises – and have every piece of information you want one which just you will allege him or her.

The web recommended fee election matter from Setting 3800, Area III, range six, column (j) is stated for the Agenda 3, range 13c. For many who made energy conserving developments to at least one or maybe more property which you put since the a house throughout the 2024, you’re capable make the domestic clean times credit. You happen to be able to raise an education credit should your scholar chooses to are all the otherwise section of a Pell grant or certain almost every other grants or fellowships within the money. Go into online step 1 small of (a) their full foreign fees, otherwise (b) the total of your number on the Setting 1040 otherwise 1040-SR, range 16, and you can Agenda 2, range 1a. Enter people income tax to your non-effectively connected earnings for your the main year you’re a great nonresident alien.

Calling the brand new Team Taxation Board

Simultaneously, the market industry value of a Cd regarding the supplementary industry will get be influenced by plenty of issues in addition to, yet not necessarily limited to, interest levels, conditions such as phone call otherwise step have, as well as the credit rating of the issuer. Fidelity currently can make a market on the Dvds we provide, but can perhaps not do it in the future. Fidelity now offers traders brokered Dvds, which can be Cds given from the financial institutions for the customers out of broker organizations. The new Cds are usually given inside the large denominations as well as the brokerage company splits him or her on the quicker denominations to have selling to help you their customers. Since the deposits is actually debt of one’s providing financial, rather than the new brokerage firm, FDIC insurance policies can be applied. For lots more, see how to sign up for Social Shelter advantages to have eligible students and how to make an application for Personal Protection Impairment Insurance policies.

Which level manage come in force on the July step one, 2024; we.elizabeth., a comparable date while the active day to the introduction of the newest coordinated vaping tool taxation regime to own Ontario, Quebec, the fresh Northwest Regions, and you may Nunavut. Essentially, prescribed persons do not make cigarette smoking or vaping items in Canada, and excise commitments are repaid while the items are imported to your Canada. Funds offers to give another given limit all the way to 2500 grams from manufactured brutal leaf smoke for importation private have fun with. When colleges, societal universities, and you can college or university regulators build a different household due to their pupils, they’re not subject to the normal GST/HST regulations to have designers, which need tax becoming paid off to the last value of a freshly built residential advanced. As an alternative, he is subject to a different set of recovering GST/HST laws and regulations lower than that they only happen GST/HST on the construction inputs.

- A dead taxpayer’s personal defense number must not be useful for tax many years pursuing the season from death, apart from property tax return aim.

- A made preparer must leave you a duplicate of one’s tax return to remain to suit your information.

- Will you be lookin a getaway to the limiting handbags from GamStop?

- Particularly, the brand new Public Shelter laws repeals rules known as the Windfall Elimination Provision (WEP) and also the Regulators Retirement Offset (GPO), and therefore along with her operate to reduce Public Protection payments to help you 2.5 million retired people.

- The fresh FDIC assures dumps owned by an only proprietorship as the a Unmarried Account of your own entrepreneur.

- For individuals who wait until years 62, the standard retirement age beneath the plan, you’d be entitled to a regular senior years advantage of step 3,100 thirty day period.

Use Taxation Worksheet and you may Projected Explore Taxation Look Table have a tendency to help you regulate how far play with income tax to statement. For many who are obligated to pay play with tax however you don’t report it on your own tax go back, you need to report and you will afford the tax to the California Service out of Income tax and you can Percentage Administration. To have here is how in order to report fool around with taxation to the brand new Ca Agency out of Income tax and Percentage Management, visit the website in the cdtfa.ca.gov and kind “Find Information about Play with Income tax” on the search bar. Make reference to the accomplished government income tax come back to done it point. Only done that it point when you are years 18 otherwise older along with recorded a california citizen tax come back in the the last season.

Repayments

Discover stands out for the dedication to minimizing fees. Your claimed’t shell out charge to own account repair, nonsufficient finance, too much withdrawals, official lender checks and you can a number of other financial features. 3SoFi doesn’t fees any membership, provider otherwise repair costs to own SoFi Checking and you will Deals. SoFi do fees a purchase fee so you can process for every outbound wire transfer. SoFi doesn’t cost you to own inbound cable transmits, however the giving lender can charge a fee. Understand the SoFi Examining & Savings Commission Piece to have info from the sofi.com/legal/banking-fees/.

Among the to arrive systems have been occupation and you can voluntary group of Upstate Ny, A lot of time Area, Connecticut, New jersey, Pennsylvania, Maryland, and you can Florida. Scrapping the new GPO manage raise monthly advantages inside the December 2025 because of the an average of 700 to own 380,100000 receiver delivering benefits according to life style spouses, the newest service found. The increase manage add up to typically step one,190 to have 390,100000 or enduring partners getting a widow otherwise widower work with. “Today, who promise could have been recovered, and resigned firemen and you may crisis medical specialists often today discovered the full Social Security advantages they usually have gained and you may paid back to your,” Kelly said. The individuals beneficiaries will discover a lump sum from the thousands from bucks and then make upwards for the shortfall within the professionals it have to have obtained within the 2024, the newest chairman said.

While you are filing a joint come back and you can both taxpayers was awarded an ip address PIN, go into both Internet protocol address PINs from the spaces considering. If you (otherwise your spouse when the submitting as you) obtained one or more delivery, profile the newest nonexempt amount of for every delivery and you can go into the full of your own taxable numbers online 4b. Go into the full level of those distributions online 4a.

Federal mediocre rates of interest to have Dvds

The insurance coverage bundle have to be centered using your team. Yours functions need been a content money-generating reason for the firm. If you are processing Schedule C or F, the policy will likely be in both their term or in the brand new term of your own team. You might have to spend an additional tax if you obtained a good taxable distribution from a great Coverdell ESA otherwise a QTP. You might have to spend an extra taxation for those who gotten a good taxable shipment out of an Archer MSA or Medicare Virtue MSA.

Rather, enter the overall amount of these credits from Plan P (540NR), Region III, Point B1, line twelve due to range 14, on the Mode 540NR, line 55. Produce “Schedule P (540NR)” left of one’s amount registered online 55. Federal Serves – As a whole, the fresh Roentgen&TC will not comply with the alterations within the following the federal acts. California taxpayers continue to stick to the IRC since the specified go out out of January step 1, 2015, that have changes. To own specific changes considering the pursuing the acts, find Agenda California (540NR) instructions. For many who be considered, you can also decide to declaration your child’s money in excess of 1,three hundred however, lower than 13,100000 on your return from the completing function FTB 3803, Parents’ Election in order to Statement Kid’s Interest and you can Returns.

In case your matter you are looking right up in the worksheet are 55,768 or more, and you have a couple being qualified students who’ve good SSNs, you could potentially’t use the borrowing from the bank. If the count you want to upwards regarding the worksheet are 49,084 or more, and you have you to being qualified man who has a valid SSN, you could’t take the borrowing. If your matter you are searching upwards regarding the worksheet is 25,511 or even more, along with zero being qualified pupils who’ve appropriate SSNs, you might’t take the borrowing. Should your amount you’re looking upwards in the worksheet is actually 18,591 or maybe more, and you’ve got zero qualifying pupils who have valid SSNs, you might’t use the credit.

You should check the newest “Being qualified enduring spouse” field in the Filing Condition area to the webpage step one out of Form 1040 otherwise 1040-SR and employ mutual come back taxation cost to own 2024 if all the of the following pertain. When you are hitched and you may file a different return, you generally statement just their money, deductions, and you will credit. Basically, you are in control just for the newest income tax your self earnings. Other laws and regulations affect members of neighborhood assets says; see Pub.